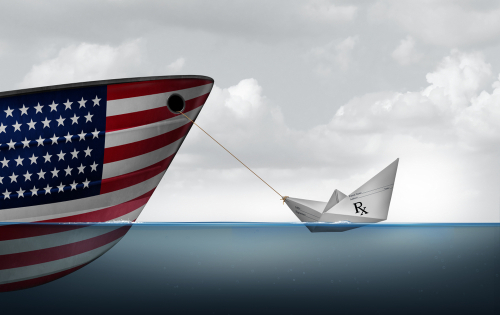

Trump’s Announcement on U.S. Drug Manufacturing: What It Means for PharmaCompanies Without U.S. Production Sites

Last week, President Trump announced that pharmaceutical companies selling drug

products in the United States will be expected to invest in U.S.-based production

facilities. While the political soundbite may seem straightforward, the legal and practical

realities—especially for small and mid-sized pharmaceutical companies—are far from

simple.

As counsel to pharmaceutical clients navigating FDA regulations over the past 20 years,

supply chain strategy, and compliance frameworks, our firm sees several immediate

implications and concerns.

- The Legal Reality: Manufacturing in the U.S. Isn’t Just About a Plant

Building a drug manufacturing facility is only the visible tip of the iceberg. A physical site

comes with an entire regulatory ecosystem, including:

• FDA’s Current Good Manufacturing Practice (cGMP) requirements

• DEA controls for controlled substances

• State licensing and facility registration

• Environmental, health, and safety compliance

• Quality systems, validation, and ongoing inspections

• Data integrity standards (particularly since 2003, when FDA and global regulators

intensified oversight)

Even for established companies, standing up a compliant facility in the U.S. is not a

single “capital expenditure”—it’s a permanent, resource-intensive operational

commitment. - The Cost and Burden Are Disproportionately Heavy for Small and Emerging

Pharma

Trump’s statement may sound patriotic and pro-manufacturing, but for startup to small

pharmaceutical companies—especially those operating virtually or through CDMOs

overseas—the proposal is extremely burdensome.

Since 2003, drug manufacturing regulations have only grown more complex, and FDA’s

interpretation of cGMP has tightened significantly. Building a compliant U.S. facility

means:

• Tens to hundreds of millions in capital costs

• A full quality and regulatory staff

• Ongoing inspection readiness

• Insurance, tax, labor, and environmental obligations

• Supply chain restructuring

For many small-market or single-product companies, the math simply does not work.

- What Happens to Companies Selling in the U.S. Without a U.S. Plant?

There is an entire tier of pharmaceutical manufacturers—domestic and foreign—that

sell into the U.S. through partnerships, licensing deals, CDMOs, or importation

pathways. These companies often have:

• Zero physical U.S. footprint

• No domestic supply chain

• No in-house manufacturing capabilities

• Regulatory reliance on 3rd-party sites outside the U.S.

If Trump’s proposal is transitioned into policy or law, these companies would face a

direct choice:

• Invest in U.S.-based facilities (alone or through joint ventures);

• Restructure their supply chains and licensing models;

• Exit the U.S. market; or

• Seek carve-outs, phased compliance, or waiver mechanisms.

The risk is most acute for small sponsors that rely entirely on contract manufacturing. - The “Everything Else” Problem: Compliance Beyond the Plant Walls

Establishing a plant is only part of the obligation. A U.S.-based

manufacturer—regardless of size—must also comply with:

• FDA establishment registration and listing requirements

• Quality management systems (QMS) and validation protocols

• Pharmacovigilance and post-market safety reporting

• Import/export rules (for components and precursors)

• Federal and state licensing

• Labeling and advertising rules

• Drug supply chain security (DSCSA) requirements

These are not optional—and compliance costs don’t scale down easily for smaller

players.

- Practical Impact on Startups and Small Pharma

For large multinational manufacturers with mixed portfolios, onshoring some production

may be feasible—especially if supported by incentives or government contracts. But for

startup, orphan drug, specialty, and generic developers without excess capital or

infrastructure, mandates of this type could:

• Stall development pipelines

• Disrupt investor confidence

• Drive consolidation or relocations

• Limit U.S. market access

• Increase drug pricing and contracting complexity

Ironically, many of the same companies are targeted to expand the domestic supply chain

Resilience could be forced out of the market altogether.

Where This Leaves the Industry Now

This announcement is not yet a binding rule, but given the political momentum around

domestic manufacturing and post-pandemic supply chain reform, the industry should

assume movement toward:

• Incentives tied to manufacturing investment

• Pricing/reimbursement leverage based on U.S. presence

• Policy-driven preference for domestic sourcing

• Contractual pressure from payors, PBMs, or federal purchasers

Companies without U.S. manufacturing need to begin evaluating risk exposure,

potential JV or CDMO partnerships in the U.S., and alternative compliance models.

Legal Advisors Will Be Critical

The question is not only whether investment will be required, but also how any mandate will

be enforced—and on whom. Legal counsel needs to guide companies on:

• Strategic risk assessment

• Contract manufacturing alternatives

• Regulatory planning and waivers

• Deal structuring and partnerships

• Exit strategies or phased implementation

Small pharmaceutical entities cannot be expected to absorb the same burdens as

multinational manufacturers—but unless the policy accounts for size, early-stage and

specialty drug developers could face existential pressure.

Contact Us

If you need help evaluating how this policy direction could impact your business, our

experienced attorneys are happy to discuss tailored strategies based on your size,

structure, and market footprint.